Tesla Employee Wealth: How Many Workers Have Reached Millionaire Status

Tesla employee wealth: understand the millionaire phenomenon

Tesla has transformed not precisely the automotive industry but to the financial trajectories of many of its employees. The question of how many tesla employees have achieved millionaire status has become a topic of significant interest, reflect both the company’s meteoric rise and its approach to employee compensation.

Tesla’s stock performance and employee wealth

Tesla’s stock has experience extraordinary growth over the past decade. This unprecedented appreciation has now impacted the wealth of tesla employees who receive stock options or purchase company shares as part of their compensation packages.

The numbers tell a compelling story:

- Tesla’s stock has increase more than 13,000 % since its IPO

- A $10,000 investment in tesla at its iIPOwould be worth over $$13 million today

- The company’s market capitalization has exceede$60000 billion at various points

This remarkable performance has created a unique wealth generation opportunity for employees at all levels of the organization.

Stock options and equity compensation at tesla

Tesla’s approach to employee compensation include substantial equity components, which has proved crucial to create employee millionaires:

- Most full-time employees receive stock options or restrict stock units (rRSS))

- Stock grants typically vest over a four-year period

- Employees at various levels can participate in equity compensation

- Performance base additional stock grants are available for exceptional contributors

This equity heavy compensation strategy align employee interests with company performance and has been instrumental in wealth creation for the workforce.

Estimate the number of tesla millionaires

While tesla doesn’t publically disclose the exact number of employee millionaires, we can make reasonable estimates base on available information:

Executive and senior leadership

Nearly all tesla executives and senior leaders have probably achieved millionaire status through their compensation packages. Sec filings show that:

- Top executives typically receive substantial stock grants

- Many senior leaders join when tesla’s stock price was importantly lower

- Roughly 50 100 top executives have stock holdings worth millions

Early employees

Employees who join tesla in its early stages (ppre-2015)and stay with the company have the greatest opportunity to become millionaires:

- Early engineers and directors receive significant equity packages

- Still lower level employees who join before the model s launch probably receive options that are nowadays worth substantial sums

- Estimates suggest 1,000 2,000 early employees may have achieved millionaire status

Mid-tenure employees

Employees who join between 2015 2019 have besides benefit from tesla’s stock appreciation:

- Mid level managers and specialized engineers from this period oftentimes receive options that have multiply in value

- Roughly 2,000 5,000 employees from this tenure group may have crossed the millionaire threshold

Recent employees

Newer tesla employees face a different wealth building trajectory:

- Those join after 2020 receive options at lots higher stock prices

- The potential for rapid wealth accumulation is lower than for early employees

- Fewer recent employees have achieved millionaire status only through tesla compensation

Factors influence tesla employee wealth

Several key factors determine whether a tesla employee become a millionaire:

Position and seniority

Not astonishingly, position within the company importantly impact wealth accumulation:

- Engineers and technical staff typically receive larger equity grants than production workers

- Directors and supra oftentimes receive equity packages explicitly design to create millionaires with strong performance

- Factory workers receive smaller equity grants but stock still participate in stock programs

Timing of employment

When an employee join tesla has proved to be possibly the virtually critical factor:

- Pre-2013 employees receive options with strike prices under $10 ((plit adjust ))

- 2013 2017 employees much receive options with strike prices between $10 50 ((plit adjust ))

- Post 2020 employees typically have options with lots higher strike prices

Retention and vest

Tesla’s vest schedule mean that stay with the company matter:

- Four year vest schedules require employee retention to capture full value

- Many employees who leave former miss significant appreciation

- Those who stay through multiple vest cycles accumulate considerably more wealth

Compare tesla to other tech companies

Tesla’s employee wealth creation compare favorably to other tech giants:

Source: usesignhouse.com

Tesla vs. Traditional automakers

The contrast with traditional automotive companies is stark:

- Traditional automakers seldom create significant numbers of employee millionaires

- Stock appreciation at companies like gm and ford has been modest compare to tesla

- Tesla’s approach to equity compensation is more align with tech companies than automotive manufacturers

Tesla vs. Tech giants

When compare to establish tech companies:

- Tesla’s wealth creation pattern resemble early google, Amazon, and apple

- The percentage of millionaires at tesla is potential higher than at mature tech companies today

- Yet, total numbers may be lower due to tesla’s smaller workforce compare to giants like apple

The impact of tesla’s compensation structure

Tesla’s approach to compensation reflect Elon Musk’s philosophy about align incentives:

Emphasis on stock over salary

Tesla oftentimes offer:

- Lower base salaries compare to competitors

- Higher equity compensation

- Performance base additional grants

This structure has created both challenges and opportunities for employees.

Wealth inequality within tesla

Not all tesla employees have equal access to wealth creation:

- Production workers typically receive smaller equity grants

- Geographic location impact compensation packages

- Contract workers oftentimes don’t receive equity compensation

Stories of tesla millionaires

While respect privacy, several patterns emerge in the stories of tesla’s employee millionaires:

Engineering success stories

Tesla’s engineering teams have produce numerous millionaires:

Source: seekingalpha.com

- Early battery engineers who join pre model s oftentimes accumulate millions in equity

- Software engineers who build tesla’s proprietary systems have often achieved millionaire status

- Manufacture engineers who help scale production have besides benefit importantly

Unexpected millionaires

Some of tesla’s nearly interesting wealth creation stories come from unexpected places:

- Administrative staff who join former and receive stock options

- Service technicians who believe in the company and invest additional personal funds in tesla stock

- Mid level managers who accept equity heavy compensation packages

The future of wealth creation at tesla

Will tesla continue to will create employee millionaires at the same rate?

Change dynamics

Several factors will influence future wealth creation:

- Tesla’s market cap is already substantial, limit potential percentage gains

- Equity grants today come at lots higher valuations

- The company continue to grow its workforce, dilute the equity pool

New opportunities

Yet, tesla continue to create wealth building opportunities:

- Expansion into new markets and products open growth potential

- Energy, AI, and robotics divisions may create new value centers

- Performance base incentives remain substantial

Lessons from tesla’s employee millionaires

The tesla millionaire phenomenon offer several insights:

The power of equity compensation

Tesla’s approach demonstrate that:

- Equity can be more valuable than salary for wealth building

- Long term thinking frequently outperform short term compensation maximization

- Alignment with company success create powerful incentives

Risk and reward balance

Tesla employees who become millionaires frequently:

- Accept lower initial compensation

- Believe in the company’s mission despite skepticism

- Weather significant volatility and uncertainty

Conclusion: the tesla millionaire count

While exact numbers remain private, reasonable estimates suggest:

- Roughly 4,000 7,000 current tesla employees have potential achieve millionaire status through their tesla compensation and stock holdings

- An additional 2,000 3,000 former employees may have besides reach this milestone

- The concentration is highest among early employees, engineers, and leadership

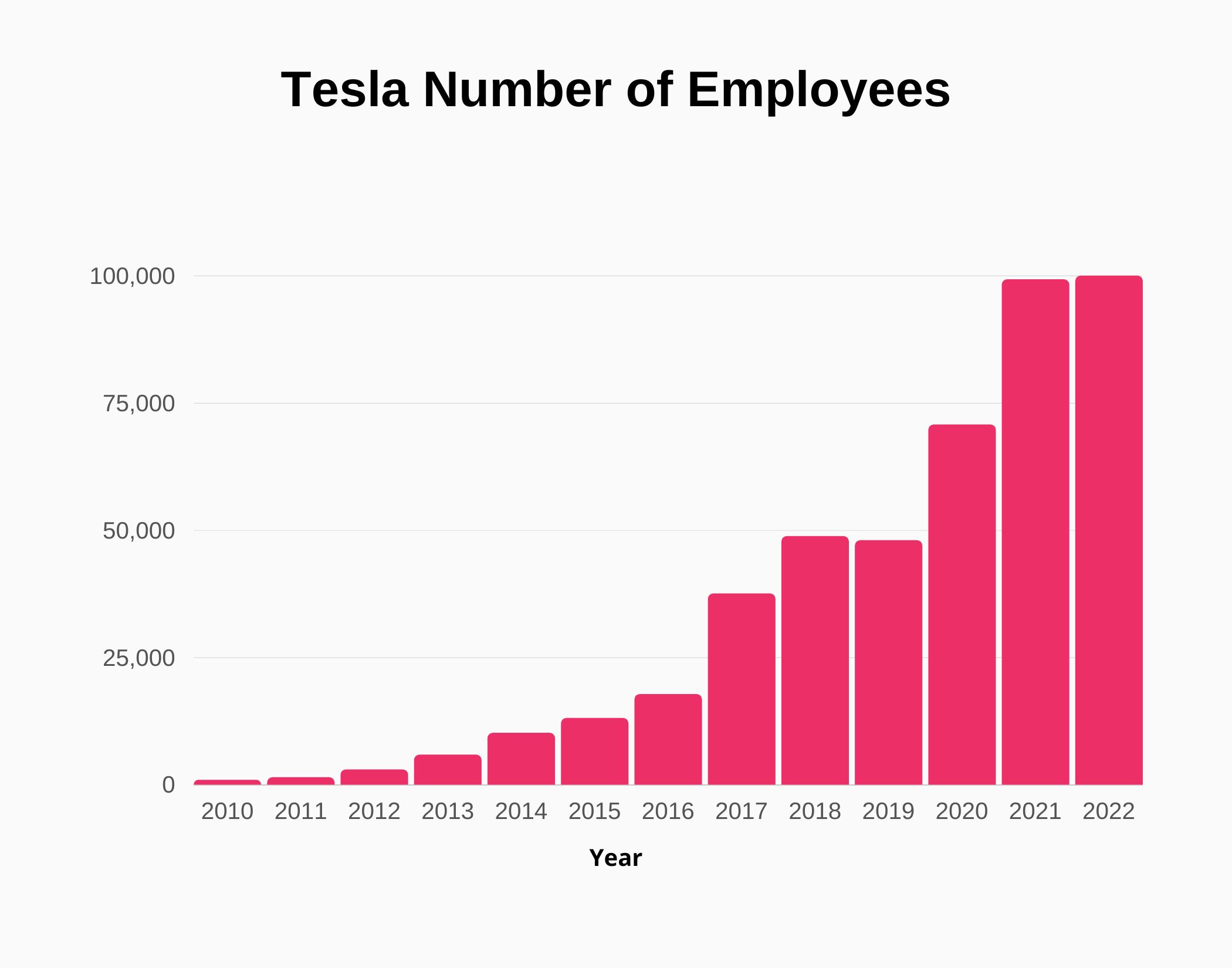

Tesla’s approach to employee compensation has created a significant cohort of employee millionaires, though they represent a minority of tesla’s current global workforce of over 100,000 employees. The company’s story demonstrate how innovative compensation structures align with explosive growth can transform employee financial trajectories.

For those interested in the intersection of corporate success and employee wealth creation, tesla provide one of the virtually compelling case studies of the modern business era.