Business Entertainment Deductions: Complete Guide to Allowable Tax Deductions

Understanding business entertainment deductions

Business entertainment expenses represent one of the virtually scrutinize areas of tax deductions. The IRS maintain strict guidelines about what qualify as deductible entertainment, and recent tax law changes have importantly altered how businesses can claim these deductions.

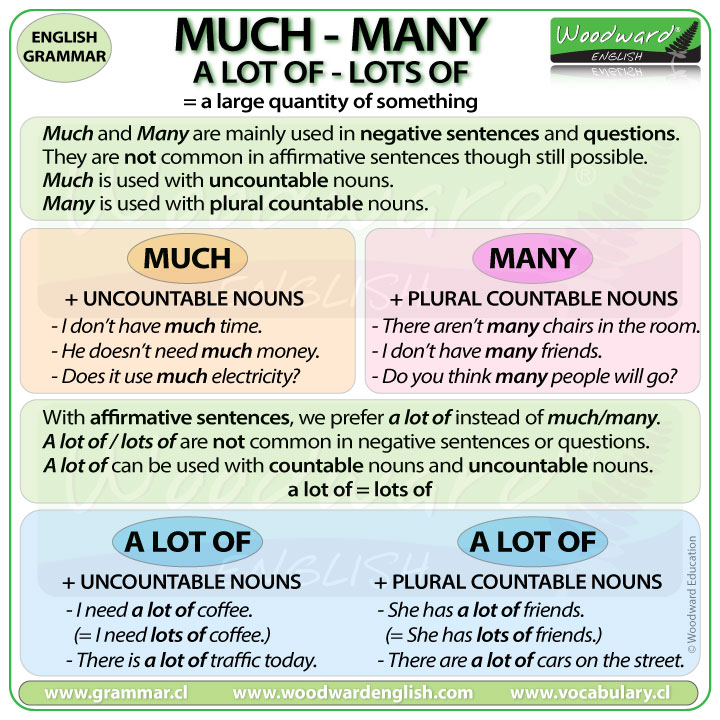

Entertainment expenses must serve a clear business purpose and follow specific documentation requirements. The key lie in understanding which expense qualify, how lots you can deduct, and what documentation proves necessary forIRSs compliance.

Source: nydailynews.com

Current entertainment deduction rules

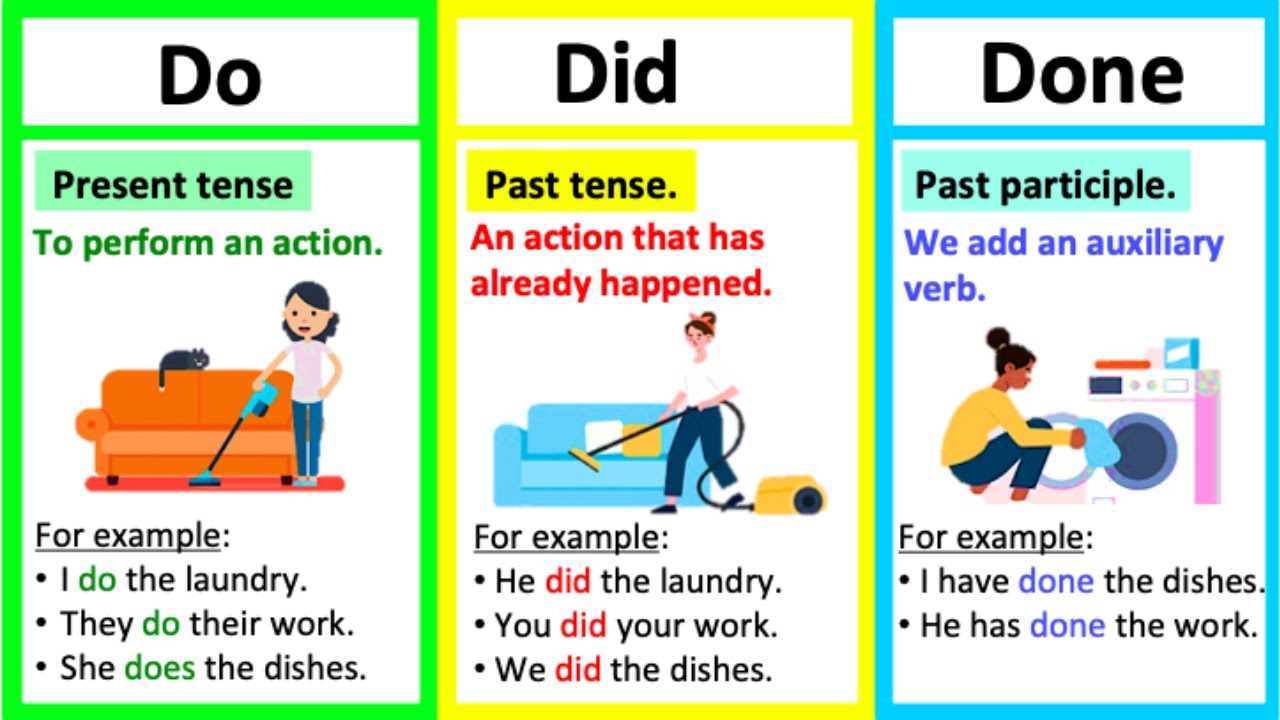

The tax cuts and jobs act basically change entertainment deduction rules. Antecedently, businesses could deduct 50 % of qualify entertainment expenses. Directly, most entertainment expenses are entirely non-deductible.

Notwithstanding, certain exceptions notwithstanding allow for deductions:

- Entertainment provide to employees as compensation

- Entertainment expenses include in employee income

- Entertainment provide to non employee third parties as taxable income

- Recreational activities mainly benefit employees

Business meals remain partly deductible under specific circumstances, but pure entertainment activities like sporting events, theater performances, or golf outings typically can not be deducted.

Calculate allowable entertainment deductions

When entertainment expenses do qualify for deduction, the calculation process requires careful attention to detail. Start by identify which expenses fall under allowable categories.

For employee entertainment that qualify as compensation, the full amount may be deductible as a business expense, but it becomes taxable income to the employee. Thiscreatese a wash effect where the business get the deduction but must handle payroll tax implications.

Recreational activities for employees follow different rules. Company picnics, holiday parties, and similar events that mainly benefit employees can be amply deductible if they meet specific criteria:

- The activity must be principally for employees

- The expense must be reasonable

- The activity can not discriminate in favor of extremely compensate employees

Business meals vs entertainment

The distinction between business meals and entertainment prove crucial for tax purposes. While entertainment expenses face severe restrictions, business meals maintain partial deductibility under the right circumstances.

Business meals can be 50 % deductible when:

- The meal occur during or immediately ahead / after a business discussion

- The taxpayer or employee is present during the meal

- The meal expense is not lavish or extravagant

- The meal serve a clear business purpose

Temporary provisions have allowed 100 % deduction for certain restaurant meals, but these provisions have specific expiration dates and conditions.

Documentation requirements

Proper documentation become essential for any entertainment relate deduction. The IRS require contemporaneous records that establish:

- Amount of the expense

- Date and location of the activity

- Business purpose of the expense

- Business relationship of persons entertain

Credit card receipts exclusively don’t satisfy documentation requirements. You need detailed records explain the business purpose and identify all participants. Many businesses use expense report systems that capture this information consistently.

Consider maintain a business entertainment log that record each event’s details instantly after it occur. Memory fade rapidly, and reconstruct business purposes months previous during tax preparation oftentimes result in lose deductions.

Common entertainment expense scenarios

Understand how different scenarios affect deductibility help business owners make informed decisions about entertainment spending.

Client entertainment

Take clients to sport events, concerts, or similar entertainment venues typically result in non-deductible expenses. Notwithstanding, if you include the entertainment value in the client’s taxable income and issue appropriate tax forms, the expense may become deductible.

This approach seldom makes practical sense for occasional client entertainment, but it might work for systematic entertainment programs with regular business partners.

Employee events

Company-wide events like holiday parties, summer picnics, or team building activities oftentimes qualify for full deductibility. These events must mainly benefit employees and can not intemperately favor extremely compensate individuals.

Department specific events or events limit to management teams face greater scrutiny and may not qualify for the same favorable treatment.

Business travel entertainment

Entertainment expenses during business travel follow the same rules as local entertainment. The travel context doesn’t create additional deduction opportunities for entertainment activities.

Source: mashable.com

Notwithstanding, meals during business travel may qualify for different treatment, peculiarly if they occur during temporary work assignments aside from your tax home.

Industry specific considerations

Certain industries traditionally rely intemperately on entertainment for business development. These businesses must adapt their practices to current tax law limitations.

Sales organizations might shift from entertainment focus client interactions to business meal settings that maintain partial deductibility. Professional services firms may emphasize educational seminars or business conferences kinda than pure entertainment events.

The construction and real estate industries, which historically use entertainment extensively for relationship building, nowadays focus more on business meals and practical demonstrations of services.

Record keep best practices

Effective record keep systems prevent lose deductions and audit problems. Digital expense tracking applications can streamline the documentation process by allow real time entry of business purposes and participant information.

Photograph receipts instantly to prevent loss or fading. Many smartphones include build in document scan features that create clear, permanent records.

Maintain separate business credit cards for entertainment expenses to simplify tracking and avoid personal use complications. This separation make year-end tax preparation more straightforward and provide cleaner audit trails.

Planning strategies for entertainment expenses

Smart tax planning involve restructure entertainment approaches to maximize available deductions while maintain business effectiveness.

Consider combine business meetings with meal settings instead than pure entertainment venues. A business lunch follows by a golf game create a partly deductible meal expense, yet though the golfremainsnon-deductiblele.

Time entertainment events around legitimate business meetings or conferences may help establish stronger business purposes, though this doesn’t change the fundamental deduction limitations.

Employee recognition programs might shift toward deductible compensation kinda than non-deductible entertainment. Cash bonuses or additional benefits may provide better tax treatment than entertainment events.

Audit considerations

Entertainment expenses attract IRS attention during audits. Auditors specifically look for attempts to disguise entertainment as deductible business expenses.

Common audit triggers include:

- Large entertainment expenses relative to business size

- Frequent entertainment expenses without clear business purposes

- Entertainment expenses that appear personal in nature

- Inadequate documentation support business purposes

Prepare for potential audits by maintain comprehensive documentation that clear establishes business purposes for any entertainment relate deductions claim.

Alternative business development approaches

Give entertainment deduction limitations, businesses progressively explore alternative relationship building strategies that offer better tax treatment.

Educational seminars and business conferences provide network opportunities while potentially qualify for full business expense deduction. These events serve clear business purposes and avoid entertainment classification issues.

Business facility tours, product demonstrations, and similar activities focus on legitimate business discussions while build relationships. These approaches frequently prove more effective than traditional entertainment for serious business development.

Charitable events where your business sponsors activities may provide better deduction opportunities through charitable contribution rules instead than entertainment expense provisions.

State and local considerations

State tax laws don’t ever mirror federal entertainment deduction rules. Some states maintain their own entertainment deduction provisions that may be more or less favorable than federal rules.

Businesses operate in multiple states must consider vary state tax treatments when plan entertainment expenses. What work for federal tax purposes might not optimize state tax obligations.

Local tax jurisdictions occasionally impose additional restrictions or requirements on business entertainment expenses, specially in areas with significant tourism or entertainment industries.

Future planning and compliance

Tax laws regard entertainment expenses continue to evolve. Stay inform about legislative changes help businesses adapt their practices and maximize available deductions.

Professional tax advice become especially valuable for businesses with significant entertainment expenses. Tax professionals can help navigate complex rules and identify legitimate deduction opportunities within current law constraints.

Regular review of entertainment expense policies ensure ongoing compliance and optimal tax treatment. What work in previous years may not remain effective under change tax law landscapes.

Consider the total cost of entertainment activities, include lose tax deductions, when evaluate business development strategies. Sometimes alternative approaches provide better overall value when tax implications are amply considered.